Estimation of production cost and revenue: Difference between revisions

| (2 intermediate revisions by 2 users not shown) | |||

| Line 159: | Line 159: | ||

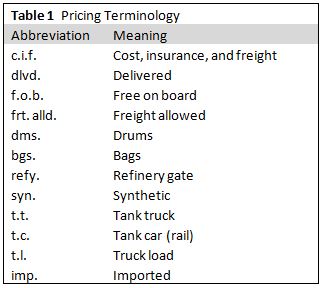

Another case study, conducted by CNN, analyzed the world market for rare earth minerals. Rare earth minerals are vital to the preparation of catalysts, which impacts a large portion of the chemical engineering industry. Additionally, rare earth minerals are used extensively in a wide variety of consumer products, including but not limited to hybrid cars and smartphone chips. Any process engineer looking to design a plant where production utilizes rare earth minerals should analyze this global market in order to influence his decisions that go into designing the process. The case study conducted by CNN highlights the fact that China is the dominant player in the global market for rare earth minerals (Yan, 2015). Per National Center for Policy Analysis, with whom CNN consulted during their case study, China controls about 95% of global rare earth mineral production, and holds half of the world’s resources of these metals. A specific subset of rare earth minerals, rare earth oxides, are vital components of many catalysts. Figure 1 below shows just how strong of a monopoly China has on these rare earth oxides in the global market. The supply crunch brought on by China forced the lone United States producer of rare earth metals, Molycorp, into bankruptcy. China having a near monopoly on the global market for rare earth metals means that they can exert their dominance on the market in several fashions. One such example came in 2010, when Beijing abruptly reducing their export quota for rare earth minerals lead to skyrocketing prices. A process engineer who’s proposed design includes the use of any catalyst using these rare earth metals must take all of these possibilities into account. In this example, does the influence China has on the global rare earth metals market make it more sensible to build a plant in China? Or maybe the volatility of the prices is too concerning, which could lead to the process engineer being forced to redesign his process without the use of a catalyst. Though this would certainly reduce product yield, it could be the case that the markets for the metals that make the necessary catalyst render the process without the catalyst more profitable on a per unit basis. This rare earth metal example is just one of many; the overall lesson is that a process engineer must evaluate the global markets for all important inputs to his process, as the profitability of different designs will be heavily influenced by these markets. |

Another case study, conducted by CNN, analyzed the world market for rare earth minerals. Rare earth minerals are vital to the preparation of catalysts, which impacts a large portion of the chemical engineering industry. Additionally, rare earth minerals are used extensively in a wide variety of consumer products, including but not limited to hybrid cars and smartphone chips. Any process engineer looking to design a plant where production utilizes rare earth minerals should analyze this global market in order to influence his decisions that go into designing the process. The case study conducted by CNN highlights the fact that China is the dominant player in the global market for rare earth minerals (Yan, 2015). Per National Center for Policy Analysis, with whom CNN consulted during their case study, China controls about 95% of global rare earth mineral production, and holds half of the world’s resources of these metals. A specific subset of rare earth minerals, rare earth oxides, are vital components of many catalysts. Figure 1 below shows just how strong of a monopoly China has on these rare earth oxides in the global market. The supply crunch brought on by China forced the lone United States producer of rare earth metals, Molycorp, into bankruptcy. China having a near monopoly on the global market for rare earth metals means that they can exert their dominance on the market in several fashions. One such example came in 2010, when Beijing abruptly reducing their export quota for rare earth minerals lead to skyrocketing prices. A process engineer who’s proposed design includes the use of any catalyst using these rare earth metals must take all of these possibilities into account. In this example, does the influence China has on the global rare earth metals market make it more sensible to build a plant in China? Or maybe the volatility of the prices is too concerning, which could lead to the process engineer being forced to redesign his process without the use of a catalyst. Though this would certainly reduce product yield, it could be the case that the markets for the metals that make the necessary catalyst render the process without the catalyst more profitable on a per unit basis. This rare earth metal example is just one of many; the overall lesson is that a process engineer must evaluate the global markets for all important inputs to his process, as the profitability of different designs will be heavily influenced by these markets. |

||

[[File:reo.jpg|frame|center|border|<div align=center> Figure 1: Global rare earth oxide production trends from 1956-2010 <div>]] |

[[File:reo.jpg|frame|center|border|<div align=center> Figure 1: Global rare earth oxide production trends from 1956-2010 (Tse, 2011) <div>]] |

||

<div align=left> |

<div align=left> |

||

| Line 179: | Line 179: | ||

The above analyses cover only a fraction of what a process engineer must consider. The analyses conducted highlight some of the major components, but there are many others that must be considered as well. Global market effects are endless, and play a large part in helping a good process engineer determine how to design a process and where to build a production facility. |

The above analyses cover only a fraction of what a process engineer must consider. The analyses conducted highlight some of the major components, but there are many others that must be considered as well. Global market effects are endless, and play a large part in helping a good process engineer determine how to design a process and where to build a production facility. |

||

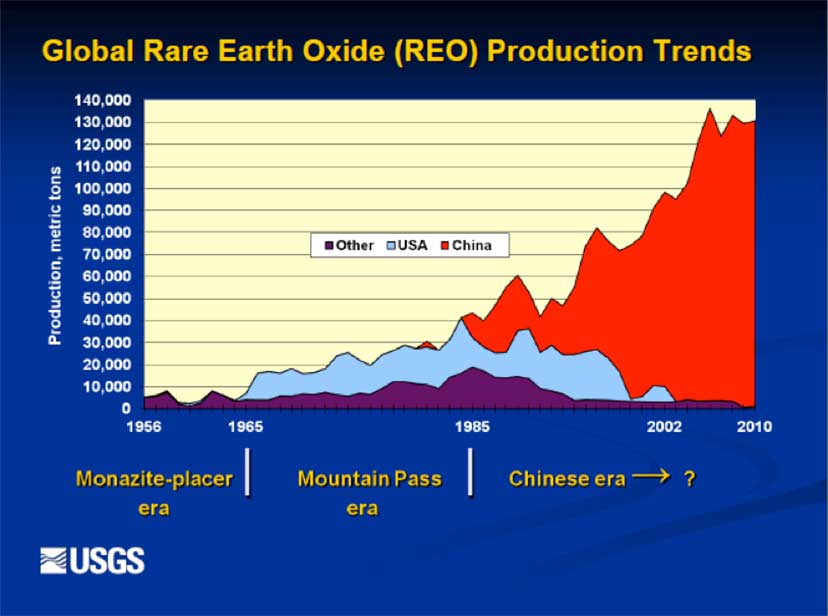

[[File:Ethanol.JPG|frame|center|border|<div align=center> Figure 2: Global ethanol production from 2007-2011 <div>]] |

[[File:Ethanol.JPG|frame|center|border|<div align=center> Figure 2: Global ethanol production from 2007-2011 (evsroll.com) <div>]] |

||

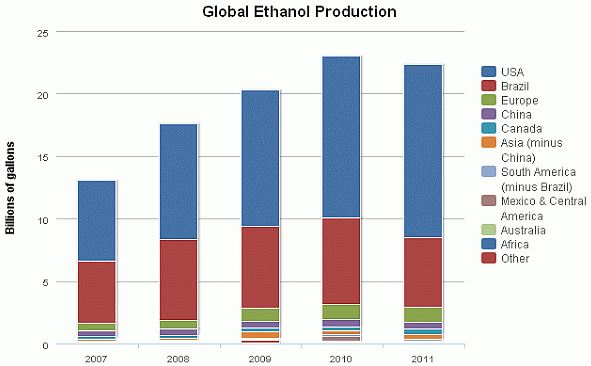

[[File:Steel.JPG|frame|center|border|<div align=center> Figure 3: Global steel prices from 2006-2012 <div>]] |

[[File:Steel.JPG|frame|center|border|<div align=center> Figure 3: Global steel prices from 2006-2012 (Gue, 2012) <div>]] |

||

<div align=left> |

<div align=left> |

||

| Line 205: | Line 205: | ||

Yan S. China is About to Tighten its Grip on Rare Earth Minerals. CNN, money.cnn.com. June 5, 2015 |

Yan S. China is About to Tighten its Grip on Rare Earth Minerals. CNN, money.cnn.com. June 5, 2015 |

||

Tse P. China’s Rare-Earth Industry. USGS. pubs.usgs.gov. 2011. Accessed February 21, 2016 |

|||

Scott R.E. The High Price of “Free” Trade: NAFTA’s Failure has Cost the United States Jobs Across the Nation. Economic Policy Institute, www.epi.org. November 17, 2003 |

Scott R.E. The High Price of “Free” Trade: NAFTA’s Failure has Cost the United States Jobs Across the Nation. Economic Policy Institute, www.epi.org. November 17, 2003 |

||

Renewable Energy Ethanol. EVs Rock. http://evsroll.com/Renewable_Energy_Ethanol.html. Accessed February 21, 2016 |

|||

Gue E. Where Steel Prices are Headed. Investing.com, www.investing.com. April 3, 2012. Accessed February 21, 2016 |

|||

Latest revision as of 11:33, 11 March 2016

Authors: Nick Pinkerton, Karen Schmidt, James Xamplas (ChE 352 in Winter 2014), Reed Kolbe (ChE 352, Winter 2016)

Steward: David Chen, Fengqi You

Variable Cost of Production

Variable costs of production are dependent primarily on plant output and rate of production. There are many variables to consider when costing a plant.

- Raw materials consumed

- Utilities-steam, electricity, cooling water, fuel, etc.

- Consumables - acids, bases, solvents, catalysts, etc.

- Disposal

- Shipping

The majority of the variable costs for a production plant are the raw materials and utilities costs. Variable costs can be greatly cut through optimization techniques and intelligent plant design (Towler and Sinnott, 2013).

Raw Materials Cost

Calculating the annual cost of a raw material is calculated by simply multiplying the feed rate of the process by the appropriate price per volume or mass. These are the costs of chemical feed stocks required by the process. Feed stocks flow rates are obtained from PFD (Turton et al., 2013).There are several ways to optimize this cost to ensure that a process is not costing more than it should. First one should assess the actual consumption of a plant to see if it is significantly different from what should be expected based on process stoichiometry and selectivities (Towler and Sinnott, 2013). Finding may prove that a process is less efficient than it originally claimed. It is smart to benchmark a new plant design against an existing plant or pilot plant. Raw materials are typically the largest contributor to overall variable costs. For bulk chemicals and petrochemicals, raw materials represent 80-90% of the total cash cost of production (CCOP).

Utilities Cost

These are the costs of the various utilities streams required by the process. The flowrates for the utilities streams are located on the PFD (Turton et al., 2013). This includes:

- Fuel gas, oil, or coal

- Electric power

- Steam

- Cooling water

- Process water

- Boiler feed water

- Air

- Inert gas

- Refrigeration

Utility streams are excellent ways to streamline a process and are often indicative of how efficient of a process the project is. Process methods such as steam generation and pinch analysis can be used to greatly reduce utility costs across a plant. Further analysis of pinch analysis techniques and optimizing heat exchanger networks can be found in plant design texts such as first reference from Gavin Towler. The determination of process utility costs is often more difficult than the determination of raw material costs; however, the utilities are typically between 5-10% of CCOP (Towler and Sinnott, 2013). The cost of heating a process can be reduced by using process waste streams as fuel which consequently also reduces the need for waste disposal.

Waste Disposal Costs

These are defined as the cost of waste treatment to protect the environment (Turton et al., 2013). These are materials that cannot be recycled or sold off as by-products. Often times these streams require additives or additional treatment to meet governmental regulations. Hydrocarbon waste can often be incinerated directly to the atmosphere or used as process fuel to heat other streams in the system. Using the stream as process fuel allows the fuel value of the stream to be recovered into the system. The substituted value can be calculated by multiplying the conventional fuel price by the heat of combustion of the waste stream.

where = waste value of fuel ($/lb or $/kg)

= price of fuel ($/MMBtu or $/GJ)

= heat of combustion (MMBtu/lb or GJ/kg)

Dilute aqueous streams must be sent to wastewater treatment typically prior to purging from the plant. Acidic or basic wastes are neutralized prior to treatment by salting out the acid or base. The cost of wastewater treatment is typically about $6 per 1000 gal but this is only an estimate that doesn't account for regional charges (Towler and Sinnott, 2013).

Solid waste treatment can typically be sent to a landfill at a cost of approximately $50/ton (Towler and Sinnott, 2013).

Hazardous wastes arise from the production of concentrated liquid streams that cannot be incinerated. Hazardous wastes should be avoided if possible, but that is not always feasible for some processes. The cost of hazardous waste disposal is strongly dependent on the location of the plant, the plants proximity to waste disposal plants and the degree of hazard of the waste.

Fixed Cost of Production

Fixed costs are those whose amounts are independent of production rates. Much of these costs are personnel salaries, taxes, insurance, and legal payments.

Labor Costs

These are the costs attributed to the personnel required to operate the process plant (Turton et al., 2013).

The number of operators required per shift, can be estimated by

where is the number of processing steps involving particulate solids and is the number of other processing steps (Turton et al., 2013). For each of the operators per 8-hour shift, approximately 4.5 operators must be hired for a plant that runs 24 hours per day, to account for the 3 shifts per day and the 3 weeks of leave typically taken by each operator per year (Turton et al., 2013). The salary for a chemical plant operator varies by location, and the estimator should look up the average value for the area.

Maintenance Costs

These are the costs associated with labor and materials necessary to maintain plant production. An estimate of these are 6% of the fixed capital investment (Turton et al., 2013).

Research and Development

These are the costs of research done in developing the process and/or products. This includes salaries for researchers as well as funds for research related equipment and supplies. An estimate of these costs are 5% of the total manufacturing cost (Turton et al., 2013).

Taxes and Insurance

Taxes vary by location, but a first estimate of property taxes and liability insurance is 3% of the fixed capital investment (Turton et al., 2013).

Plant Overhead

Overhead costs are the miscellaneous but necessary costs of running a business, including payroll, employee benefits, and janitorial services. This may be estimated as 70% of the operating labor costs, added to 4% of the fixed capital costs (Turton et al., 2013).

Licensing and Royalties

The costs of paying for the use of intellectual property clearly varies, but an estimate that may be used is 3% of the total manufacturing cost (Turton et al., 2013).

Revenues

The revenues of a process are the income earned form sales of the main products and the by-products. Revenue can be impacted by market fluctuations and production rates.

By-Product Revenues

Besides selling the main product from a process, by-products from separations and reactions can also be valuable in the market. Often it is more difficult to decide which by-products to recover and purify than it is to make decisions on the main product.

By-products made in stoichiometric ratios from reactions must be either sold off or managed through waste disposal. Other by-products are sometimes produced through feed impurities or by nonselective reactions. There are several potential valuable by-products from a process:

- Materials produced in stoichiometric quantities by the reactions that create the main product. If they are not recovered then the waste disposal expenses will be large.

- Components that are produced in high yield by side reactions.

- Components formed in high yield from feed impurities. Many sulfurs are produced as a by-product of fuels manufacture.

- Components that are produced in low yield but have high value. An example includes acetophenone which is recovered as a by-product of phenol manufacture.

- Degraded consumables (e.g. solvents, etc.) that have reuse value.

A rule of thumb that can be used for preliminary screening of by-products for large plants is that for by-product recovery to be economically feasible the net benefit must be greater than $200,000 a year. A net benefit can be calculated by adding the possible resale value of the by-product and the avoided waste disposal cost (Towler and Sinnott, 2013).

Margin

The gross margin of a process is defined as the sum of product and by-product revenues minus the raw material cost.

Gross margin = Revenues - Raw materials costs

Because raw materials are most often the most expensive variable cost of a process, the gross margin is a good gauge as to what the total profitability of a process will be. Raw materials and product pricing are often subject to high degrees of variability which can be difficult to forecast. The size of margins are highly versatile depending on the industry. For many petrochemical industries the margin may be only 10%; however, for industries such as food additives and pharmaceuticals the margins are generally much higher (Towler and Sinnott, 2013).

Profits

There are several standards for calculating company profits. The cash cost of production (CCOP) is the sum of the fixed and variable production costs.

where is the variable cost of production and is the fixed cost of production.

Gross profit, which should not be confused with gross margin, is then calculated by the following equation,

Finally profit can be calculated by subtracting the income taxes that the plant would be subject to depending on the tax code of the county the plant is located in.

Pricing Products and Raw Materials

The revenues and costs of a project are vital to determining its economic feasibility. To calculate these values one needs to multiply the respective product and feed streams by their respective prices. The major difficulty of this process is determining the prices that should be used in this formula. When analyzing a plant, not only do the current prices need to be acknowledged but also the stability of the market to forecast future fluctuations and deviations.

Pricing Fundamentals

The pricing of a substance is determined by the fundamental economic principles of supply and demand. A supply curve and demand curve can be graphed and added to determine the market equilibrium price and projected market size. There are many ways a company can combat if the market equilibrium pricing is not suitable for a process. One of these ways is changing the market that the company is selling to. Instead of selling industrial grade product there may be markets for pharmaceutical grade or food grade that would allow for a company to sell their product at higher margins. Another avenue to look into is changing the geographic market being sold to. Rarely is there a global synchronous market, but rather a variation depending on where in the world the product is being sold. It is possible that a company could make more money by dedicating their sales to the Asian market as opposed to the US or vise versa.

Price Data Sources

There are many resources when trying to determine the price of a chemical or utility. This are important for looking at current pricing information as well as historical data that can be used for forecasting purposes.

Internal Company Forecasts

Large companies will often have the marketing or development departments develop a forecasting database that can be used internally in the company. Forecasts of this magnitude will often have multiple scenarios and projects that are evaluated under the given parameters. Companies may even license these forecasts to other companies for high fees if they desire.

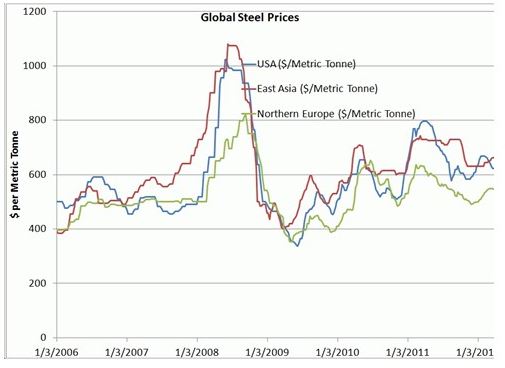

Table 1 provides common industry acronyms that are used to indicate certain key words when determining pricing information.

Trade Journals

There are also many publications that report pricing data weekly. ICIS Chemical Business Americas used to publish the prices for hundreds of chemicals but have more recently changed their data to an online database that requires a subscription. This service is very expensive, but necessary for many companies. Oil and Gas Journal publishes the market prices of many crude oils and other petrochemicals using data from several continents. This journal also provides margin data for many refineries and plants on a monthly basis. Chemical Week provides the spot and contract prices for 22 chemicals in the US and European markets.

Consultants

If trade journals are not adequate for the information needed, some companies will contract consultants to do deep research into the subject. Consultants are excellent resources for providing economic and marketing information but come at a large price. There are several companies that provide this type of service but some of the larger firms include: Purvin and Gertz, Cambidge Energy Research Associates, Chemical Markets Associates Inc., and SRI: The Chemical Economics Handbook

Online Brokers and Suppliers

Often time price data can be supplied by the supplier themselves and using online directories. Restraint should be used when quoting these prices however because they are often spot prices that are much higher than what would be expected from bulk contract supplying.

Example Case: Estimating Cost of Production

Use the following information to estimate the manufacturing cost of a plant producing 120*10^6 lb/year with a product price of $0.20/lb.

- Fixed Capital: $15,000,000

- Working Capital: $3,000,000

- Fixed and Working Capital = FC + WC = $18,000,000

- Raw Material Cost: $9,600,000/yr

- Utilities: $1,440,000/yr

- Labor: $1,800,000/yr

- Maintenance (6% yr f.c.): $900,000/yr

- Supplies (2% yr f.c.): $300,000/yr

- Depreciation (8%/yr): $1,200,000/yr

- Taxes, insurance (3%/yr): $450,000/yr

- Total Manufacturing Cost = RMC + U + L + M + S + D + T = $15,690,000/yr

- Gross Sales = Production * Product price = $24,000,000/yr

- Gross Profit = Gross Sales - Manufacturing Cost = $8,310,000/yr

Market Effects on Process Design

Process design, like most other things, is inherently dependent on global markets, and the economy as a whole. Process design can depend on locational markets. For example, if an expected long run exchange rate between two specific currencies makes production of a specific chemical more profitable in a colder climate such as Russia as opposed to a warmer climate such as Mexico, this may have an effect on how the process to produce this specific chemical should be designed. Relative inflation rates of different countries can have similar effects on process design. Additionally, markets for key production inputs can have an effect on process design. If a company was designing a large scale production plant which required massive amounts of steel, the global market for steel (or to a lesser extent, iron mines) would impact how/where this company would choose to design and build their process. Also worth noting is the fact that the state of the economy as a whole may impact process design as well. If the economy is in a recession, funds are likely to be more tightly managed within a company. Thusly, it may make sense for a process engineer to design a process that operates on a smaller scale. Not only will this decrease the cost of running the process (lower utilities costs, lower costs for process inputs), but since less product will be produced, this will also reduce the risk of having the company running an inventory. This is a positive, as running an inventory can lead to losing even more money during a recession. Conversely, a healthy economy may encourage the design of facilities with larger production capabilities. This section aims to look at several recent examples of macroeconomic markets affecting process design, similar to the hypothetical situations described above.

Back in 2009, when the USA, UK, and many other first world countries were facing a harsh recession, both the profitability and scale of many production processes diminished. The Royal Society of Chemistry found that many chemical companies with plants located in England, when faced with the recession, elected to shut down production entirely rather than simply slow down production (RSC, 2009). Many of these plant closings were accompanied with the construction of new plants in areas of the world less affected by the recession, including the Middle East. Many notable international companies, such as Dow, were involved in this migration from countries entrenched in recession to countries where production would be more economical. While this may seem obvious, it is still worth noting that a process engineer needs to take into account the state of the economy in the location where a production facility is looking to be built.

Building off of what the Royal Society of Chemistry found, a 2010 KPMG case study aimed to further analyze the effects of the recession on chemical production plants. Though the KPMG case study was based on United States production, the economic climate in the UK was similar to that of the United States, so similar conclusions can be drawn from both studies. What KPMG found in the United States in 2010 backed up what the Royal Society of Chemistry found in England in 2009. The United States was seeing a similar outsourcing of both old production facilities that were being shut down and new production facilities that, though initially proposed for construction in the United States, were being outsourced. However, KPMG went further in depth to analyze how specific markets in the United States were affecting chemical production plants. They found that the domestic auto industry and the construction sector heavily influenced the number and scale of chemical plants being proposed for construction in the USA. This makes sense, as these are two of the largest markets for chemicals in the USA. By 2010, the domestic auto industry was rebounding, and this was found to be largely correlated with an increase in demand for US chemicals (KPMG, 2010). This highlights that a process engineer must consider what sectors use the output of his process (in this scenario, various chemicals) as an input to their process. Analyzing these specific markets in several competitive locations could provide the final input into determining where to build a production facility.

Another case study, conducted by CNN, analyzed the world market for rare earth minerals. Rare earth minerals are vital to the preparation of catalysts, which impacts a large portion of the chemical engineering industry. Additionally, rare earth minerals are used extensively in a wide variety of consumer products, including but not limited to hybrid cars and smartphone chips. Any process engineer looking to design a plant where production utilizes rare earth minerals should analyze this global market in order to influence his decisions that go into designing the process. The case study conducted by CNN highlights the fact that China is the dominant player in the global market for rare earth minerals (Yan, 2015). Per National Center for Policy Analysis, with whom CNN consulted during their case study, China controls about 95% of global rare earth mineral production, and holds half of the world’s resources of these metals. A specific subset of rare earth minerals, rare earth oxides, are vital components of many catalysts. Figure 1 below shows just how strong of a monopoly China has on these rare earth oxides in the global market. The supply crunch brought on by China forced the lone United States producer of rare earth metals, Molycorp, into bankruptcy. China having a near monopoly on the global market for rare earth metals means that they can exert their dominance on the market in several fashions. One such example came in 2010, when Beijing abruptly reducing their export quota for rare earth minerals lead to skyrocketing prices. A process engineer who’s proposed design includes the use of any catalyst using these rare earth metals must take all of these possibilities into account. In this example, does the influence China has on the global rare earth metals market make it more sensible to build a plant in China? Or maybe the volatility of the prices is too concerning, which could lead to the process engineer being forced to redesign his process without the use of a catalyst. Though this would certainly reduce product yield, it could be the case that the markets for the metals that make the necessary catalyst render the process without the catalyst more profitable on a per unit basis. This rare earth metal example is just one of many; the overall lesson is that a process engineer must evaluate the global markets for all important inputs to his process, as the profitability of different designs will be heavily influenced by these markets.

A third case study conducted by the Economic Policy Institute analyzed broad world market effects in the form of trade agreements. A trade agreement is a tax, tariff and trade treaty between two or more nations that often includes investment guarantees. One prominent example of a trade agreement is the North American Free Trade Agreement (NAFTA), which was signed in 1993. NAFTA is a trilateral rules based trade bloc between the United States, Canada and Mexico. One of the biggest effects of NAFTA was the movement of chemical and manufacturing plants from the United States to Canada and Mexico. In the first decade of the act (1993-2002), approximately 880,000 U.S. jobs were lost to Canada and Mexico (Scott, 2003). As a result of the influx of jobs, real wages dropped in Mexico, causing the operation of plants and processing facilities in Mexico to be more profitable than in the United States. This in turn lead to more factories moving to Mexico, and the cycle perpetuated. NAFTA is just one example of many trade agreements which had this effect. Globally, trade agreements between developed and developing countries leads to a migration of jobs (and the accompanying lowering of wages) to the developing countries. A process engineer needs to analyze trade agreements between the country in which he works and any countries with which his country has trade agreements. Not only will he likely find cheaper labor in other countries, but depending on the trade agreement, there may be tax breaks, import deals, or a variety of other money saving clauses written in the trade agreement. Overall, regardless of whatever the process may be, a process engineer can save his company millions of dollars by simply analyzing trade agreements and optimizing plant location.

Example

As a final example to sum up some of these global market impacts on a process engineer’s decisions, imagine the following hypothetical process: the production of a new biofuel using ethanol as an input, a catalyzed packed bed reactor to produce the biofuel with carbon dioxide being one of the byproducts, and a distillation column required to purify the product. Let us say that the process engineer is deciding between China and the United States as a location for the plant.

First of all, seeing as how ethanol is the main feed, if is obviously necessary to look into the global market for ethanol. As can be seen below in Figure 2, the United States and Brazil are the two dominant players in terms of production. This would mean that, despite the relative volatility of ethanol prices, it is reasonable to expect that ethanol would be the cheapest in either of these two countries, since acquiring ethanol would not include shipping costs and/or import tariffs. This favors the United States as the location for this plantAs a quick tangent, since a large amount of ethanol is derived from corn, a process engineer should look into future expected trends for corn globally.

Next comes the catalyzed reactor. As highlighted previously, China dwarfs the United States in terms of control of the rare earth metals that go into producing many catalysts. Due to the dominance of China in the rare earth oxide catalysts market, this would favor China as a location for production. Based on the fact that the two important inputs for this process (ethanol and the catalyst) aren’t both cheaper in either the U.S. or China, a process engineer could alter the process to favor one location. For example, if plant production in the U.S. was desirable, perhaps a lesser quality catalyst without as many rare earth metals could be utilized, which would require a larger amount of ethanol in the feed to meet a desired product quantity. This would cut costs on the catalyst (which is much more expensive in the U.S.) while the increase in costs for ethanol (due to increased quantity) would not outweigh the savings on catalyst.

The two main products exiting this hypothetical reactor are product biofuel and byproduct carbon dioxide. China recently announced that they will implement a national cap-and-trade system for greenhouse gas emissions in 2017, whereas the United States currently has no policy for taxing greenhouse gas emissions. However, it is highly likely that the United States will soon implement a carbon tax policy similar to Canada’s successful carbon tax policy introduced in 2008. Let us suppose for the sake of this example that a carbon tax will be implemented in the United States in 2017, the same time as China’s policy will come into effect. The cap-and-trade system in China and carbon tax system in the U.S. are very different policies. A carbon tax imposes a flat tax on each unit of carbon dioxide emitted, whereas a cap-and-trade system sets a maximum level of pollution and sells emissions permits to companies allowing them to emit up to the maximum level. Depending on the scale of the process and the quantity of carbon dioxide being released, one policy might be much more favorable, and thusly a process engineer must look into this further.

A final aspect to consider is simply the costs associated with any plant. Though there are many costs associated with building and running a plant, two large costs will be analyzed here. The cost of steel required to build the plant, and the cost of labor required to operate the plant. Even though the price of steel is relatively volatile, the per unit costs in China and the U.S. have remained quite close to one another. As for labor, costs are generally lower in China overall, but a process engineer must look into specific salaries for each position at the production facility. Even though China as a whole has less expensive labor, a plant operator for biofuels production may be a much higher paying position in China than it is in the U.S. Overall, taking all of these factors into account, it may make sense for a process engineer to either favor production in one country over another, or alter the process in order to favor one country if he is not in control of where the production facility is being built.

The above analyses cover only a fraction of what a process engineer must consider. The analyses conducted highlight some of the major components, but there are many others that must be considered as well. Global market effects are endless, and play a large part in helping a good process engineer determine how to design a process and where to build a production facility.

Conclusion

Thermodynamics and kinetics are essential to designing an operational plant, but at the end of the day profits and margins are what make plants go from the engineering paper pad to operating continuously. Before any ground is broken, estimation of production costs and revenues are absolutely necessary to assure CEO's and shareholders that this process is a profitable and worth while venture. There are many avenues to achieve these answers with some being more accurate than others. The best indicator of these answers will be in pilot plant design which will provide appropriate estimations for scaled up processes.

References

Biegler LT, Grossmann IE, Westerberg AW. Systematic Methods of Chemical Process Design. Upper Saddle River: Prentice Hall; 1997.

Peters MS, Timmerhaus KD. Plant Design and Economics for Chemical Engineers. 5th ed. New York: McGraw Hill; 2003.

Seider WD, Seader JD, Lewin DR. Process Design Principles: Synthesis, Analysis, and Evaluation. 3rd ed. New York: Wiley; 2004.

Towler G, Sinnott R. Chemical Engineering Design: Principles, Practice and Economics of Plant and Process Design. 2nd ed. Boston: Elsevier; 2013.

Turton R, Bailie RC, Whiting WB, Shaewitz JA, Bhattacharyya D. Analysis, Synthesis, and Design of Chemical Processes. 4th ed. Upper Saddle River: Prentice-Hall; 2012.

Chemicals Sector Struggles in Recession. Royal Society of Chemistry, rsc.org. July 29, 2009

The Outlook for the US Chemical Industry. KPMG, kpmg.com. 2010.

Yan S. China is About to Tighten its Grip on Rare Earth Minerals. CNN, money.cnn.com. June 5, 2015

Tse P. China’s Rare-Earth Industry. USGS. pubs.usgs.gov. 2011. Accessed February 21, 2016

Scott R.E. The High Price of “Free” Trade: NAFTA’s Failure has Cost the United States Jobs Across the Nation. Economic Policy Institute, www.epi.org. November 17, 2003

Renewable Energy Ethanol. EVs Rock. http://evsroll.com/Renewable_Energy_Ethanol.html. Accessed February 21, 2016

Gue E. Where Steel Prices are Headed. Investing.com, www.investing.com. April 3, 2012. Accessed February 21, 2016