Shale Gas to Ethylene (G1): Difference between revisions

Tahirkapoor (talk | contribs) No edit summary |

Tahirkapoor (talk | contribs) |

||

| Line 113: | Line 113: | ||

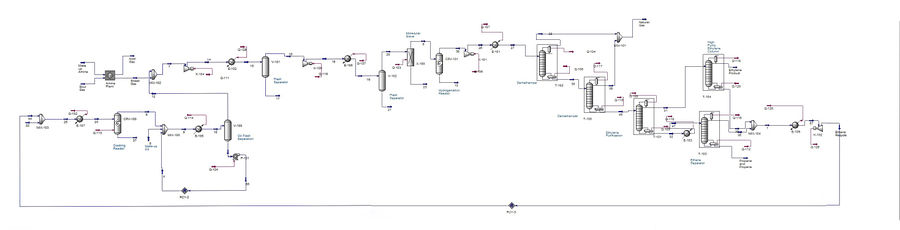

An overview of the process simulation is shown below. More stream tables and figures can be found in the appendix. |

An overview of the process simulation is shown below. More stream tables and figures can be found in the appendix. |

||

[[File:Final_Hysys_PictureG1. |

[[File:Final_Hysys_PictureG1.jpg|center|thumb|upright=3|Simulation in Aspen HYSYS V 8.0]] |

||

=Economic Analysis= |

=Economic Analysis= |

||

Revision as of 12:46, 13 March 2015

Team G1 Final Report

Authors: Tahir Kapoor, Brandon Muncy, Alex Valdes

Instructors: Fengqi You, David Wegerer

March 13, 2015

Executive Summary

The purpose of this project was to design a natural gas processing plant integrated with an ethylene production plant. Taking raw shale gas as input, pipeline quality natural gas and polymer grade ethylene are produced in high quantities.

The plant is located in Stark County, Ohio, due to its proximity to the Marcellus Shale Region and favorable state tax rates. The Marcellus Region is a massive source of shale gas in the United States and is currently underdeveloped. The plant is designed to process 13.5 MMM kg of gas, and produce 11 MMM kg of sales gas and 1.6 MMM kg of ethylene, per annum.

The proposed design relies on industrially proven technology. Initially, acid gases in the raw gas are removed via amine absorption. Next, the sweet gas is mixed with cracked gas products and sent to flash drums and a molecular sieve column to remove heavy hydrocarbons and water. Front end dehydrogenation is then used to eliminate acetylene byproduct. Cryogenic distillation columns are then used to isolate methane, ethylene, and ethane from heavier hydrocarbons (C3+). Methane and ethylene are sold as product, and ethane is recycled to the cracking furnace. Natural gas combustion within the furnace raises temperatures high enough to induce the cracking reaction that converts ethane to ethylene. The cracked gas effluent is rapidly quenched with heavy oil and water before being mixed with the sweet shale gas. These operations were simulated in Aspen HYSYS v8.0.

Based on HYSYS economic analyzer and commonly used correlations, the following cost data was calculated: capital cost (equipment purchase and installation) 1.2-1.6 MMM USD, fixed operating cost 0.10 MMM USD, and variable operating cost (heating/cooling utilities, electricity, and raw materials) 2.0 MMM USD. Total revenue from selling sales gas, ethylene, and other side products at current prices is 2.1 MMM USD. However, commodities futures from the Chicago Mercantile Exchange predict that oil and ethylene prices will rebound from their recent drop. Based on these futures, revenue is expected to be approximately 2.9 MMM USD on average between 2017-2026. Assuming plant construction takes two years, and production begins the third year, the net present value over twelve years is 1.2 MMM USD, with a payback period of six years. It is very important to note that the cost estimations are extremely sensitive to commodities prices and future energy crises can greatly impact profitability. A sustained 11% fall in natural gas prices over the projected revenues will result in a net present value of 0 USD.

This design analysis is a reasonable starting point in terms of evaluating essential process technology, equipment setup, and cost estimation. However, this analysis does not consider many aspects, notably process controls or detailed reactor design. Therefore, more research is necessary before the design is complete and the plant is ready for construction.

Introduction

The goal of this project is to design a process for the manufacture of ethylene from shale gas. Ethylene is a fundamental chemical in the production of various important polymers, including poly(ethylene terephthalate), low density polyethylene, and high density polyethylene. For this reason, ethylene is the most produced organic chemical in the world and demand will soon surpass 200 million metric tons per year.

Market Analysis and Design Basis

The Marcellus shale in the northeastern states contains the largest reserve of natural gas in America. It is estimated that 141 trillion cubic feet of gas reserves are present in the Marcellus shale.6 Gas production in the Marcellus shale was insignificant before 2008, but has rapidly risen to be one of the most important areas in the American energy industry with over 14 billion cubic feet of gas being extracted every day in 2014. As a result of this rapid energy boom in the Marcellus shale region, gas processing infrastructure has not been able to keep up with the amount of gas being extracted and much of the processing that is done to the raw shale gas occurs on refineries located in either the east coast or the gulf coast.

Due to the infant nature of gas processing infrastructure in the Marcellus region, it is very attractive to build a processing plant directly on the Marcellus shale. Eastern Ohio provides a good location for a new large scale gas processing plant due to the presence of several major pipelines (which West Virginia lacks) and favorable taxes. Ohio has a gross receipts tax of 0.26% compared to a 9.99% corporate tax rate in Pennsylvania and a 7.1% rate in New York. Ohio is also a good location for a large capital investment due to generally lax hydraulic fracturing regulations compared to other more progressive states in the Marcellus shale. Stark County is an ideal location within Ohio due to lower county taxes (6.50%) and its close proximity to Pittsburgh, where most existing wells are located. Stark county also has the added benefit of having existing gas pipeline infrastructure running through it, minimizing potential capital expenditure.

Due to the size of the immense reserves in the Marcellus shale and the void of natural gas processing plants, a large volume plant would be demanded to cope with the rising number of shale wells. Current liquefied natural gas (LNG) plants in the northeast can process 60,000 barrels per day (bpd) while production of gas from the Marcellus shale in 2016 is forecast to exceed 650,000 bpd.6 Due to this large discrepancy between projected production and existing capacity, a large gulf coast LNG plant was used for capacity determination (Freeport, Texas LNG terminal will refine up to 2.1 bcf of gas per day). By this comparison and the capability of the market to handle large volumes of ethylene production, the plant should be designed for the processing of 2 billion cubic feet (38 MM kg) of raw shale gas per day. Current use of ethylene is around 156 million tonnes/year worldwide. Targeting around 1% of this market would yield a plant producing around 1.5 million tonnes of ethylene per year, which is also near the size of larger plants in Texas. These large Gulf plants were used because the Marcellus shale region is underdeveloped so a comparison to existing plants in the region would fail to account for forecasted growth in the area.

Currently, a weak energy market threatens production of oil and gas from the Marcellus shale. A supply glut of oil has led to greatly reduced oil prices and a decline in investment in non-traditional oil fields such as shale oil. Higher production costs of shale oil reduce profitability when compared to cheaper drilling in the Middle East. Along with the decline in oil prices, natural gas and refined products such as ethylene have also experience dramatic fall in prices. It is important to consider the instability in oil prices when analyzing the benefit of a large, long term capital investment. Sustained low oil prices will reduce investment in the Marcellus shale region and will decrease gas production volumes. Despite these risks, the large gap in gas production and gas processing capacity in the Marcellus shale indicate that there is a market for a new gas purification plant.

Design Basis

Based on analyzing the current market, our design will be based on the following production targets.

| Component | Annual Production (MMkg/Year) |

|---|---|

| Shale Gas | 13,300 |

| Processed Natural Gas | < 11,000 |

| Ethylene | < 1,500 |

Process Technologies and Alternatives

Steam Cracking

Steam cracking to produce olefins has been the industry standard for decades, but many process details can be tweaked for specific production goals. Steam cracking involves diluting saturated hydrocarbons with steam and heating up to high temperatures in the absence of oxygen to produce smaller hydrocarbons and unsaturated olefins. Factors such as temperature, pressure, and residence time all have effects on the cracking reaction.

One of the most important considerations is selectivity of cracked products. Heavy hydrocarbons readily decompose to various molecules, but even a highly pure stream of ethane can form many different molecules at high temperatures. This process focuses on maximizing the selectivity of ethylene product. Both temperature and residence time heavily affect the selectivity. Higher temperatures increase ethane conversion since ethane to ethylene is an equilibrium limited reaction, but it also decreases selectivity of ethylene. Furthermore, at high residence times, the reaction forms byproducts like acetylene and methane. It has been found that ideal conditions for ethylene selectivity are temperatures between 750 and 850 C and residence times of 200 to 500 milliseconds. It is important to quench the reactor effluent quickly to avoid continued reactions. To remove a vast amount of heat in a very short time, heavy heating oils are commonly injected into the effluent stream and separated later. Additionally, pressure plays a limited role in this reaction, but many literature sources and patents reference reaction pressures of 2 barg or 0.25 barg at the outlet.

One alternative to steam cracking is microwave cracking. At laboratory scale, high conversions and high ethylene selectivity have been obtained. Rather than using a furnace to heat the gas, 2.45 GHz microwaves are capable of energy efficient heating. Although this technology is currently still in development, it has the potential to cut back on energy input costs of cracking applications in the future (SITE AICHE WEBSITE, in memo2).

Natural Gas Processing

Raw shale gas pipelined from reservoir or wellheads is first flash separated into oil and gas components. Next, the gas goes through an acid gas absorption process using amine solvent technology. The sour gas goes through sulfur recovery and tail gas cleanup processes to convert hydrogen sulfide to elemental sulfur. The sweet gas has water vapor can be removed (dehydration) by adsorption with liquid triethylene glycol or by using molecular sieves.2 The dry gas is then cryogenically distilled to separate NGLs from methane. The methane must be cryogenically distilled again to remove excess nitrogen before being sold as sales gas for heating. In order to isolate the ethane from other NGLs, a series of distillation columns are used in a fractionation train. The ethane is then pipelined to a local ethylene plant to be converted to ethylene.

The process below integrates the ethylene plant with natural gas processing. Therefore, a front-end hydrogenation reactor is placed before the fractionation train to remove acetylene. This reactor may hold palladium, platinum, or rhodium catalyst, or may be replaced altogether with a selective absorber using DMF, NMP, or acetone. Additionally, another cryogenic distillation column is added to the fractionation train to isolate ethylene. Alternatively, ethylene can be absorbed with novel solvents such as CuCl/aniline/n-methyl pyrrolidone or AgNO3

Process Overview

Add Block Flow Diagram

Process Simulation

Simulation Basis

Two fluid packages were needed for accurate simulation of the various sections of the process. The Peng-Robinson (PR) fluid package was selected as the default because the process contains mainly non-polar hydrocarbons. Thus, there are no strongly polar interactions such as hydrogen bonding present in the process. The PR equation of state (EOS) can accurately simulate these compounds without requiring supplementary data, unlike many other EOS.

In addition to the PR EOS, the Amine fluid package was necessary for the acid gas absorption/stripping system. This package can model behavior of the solvent monoethanolamine, which chemically absorbs carbon dioxide from raw shale gas.

To achieve the desired production of 1.5 MM metric tons of ethylene per year, 1.6 MM kg/hr of raw sour wet gas feedstock from the marcellus shale is required, assuming a continuously operating plant for 50 weeks per year.

Simulation Assumptions

In this initial process simulation, a few assumptions were made to generate our system model. The feed composition was set using data collected from a fracking well in western Pennsylvania and is shown in the table below.

| Component | Mole Fraction |

|---|---|

| Methane | 82.80% |

| Ethane | 14.30% |

| Propane | 2.50% |

| Nitrogen | 0.40% |

| CO2 | 0.04% |

| H2S | >10 PPM |

The most notable assumption, to simplify the cracking furnace, the reactor was modeled as a conversion reactor rather than a more realistic kinetic reactor. Conversion data from literature values of similar cracking simulations are shown below.

Many of the smaller side reactions were not added to further simplify the simulations. Our simulated cracking reaction only included ethylene, methane, propylene, butadiene, and hydrogen products. More detailed simulations in the future could utilize a more advanced kinetic reactors and include side products such as benzene and C4+ hydrocarbons. Many less impactful assumptions were made throughout the process simulation. The reactor was assumed to be an ideal, isothermal reactor with no coking. A single cracking reactor was also used in the simulation while it will actually consist of 8-10 crackers in parallel due to limitations on furnace size, maintenance, and feed surge requirements. The molecular sieve used to remove trace amounts of water was modeled as a fractionator that completely removes any water. It was assumed that no reactions occur outside of the cracking and hydrogenation reactors, which was completely converts all acetylene to ethylene. These are reasonable assumptions due to rapid quenching after the cracking process and the use of a selective solid catalyst in the hydrogenation reactor.

Process Simulation

An overview of the process simulation is shown below. More stream tables and figures can be found in the appendix.

Economic Analysis

Capital Costs

Capital cost estimates were obtained by using HYSYS economic analyzer and correlations from Towler and Sinnott for equipment units HYSYS failed to cost. By summing individual equipment components, and adding a 25% correction factor, total capital cost was estimated to be ~1.2 billion USD. Additionally, Towler and Sinnott includes an overall correlation for building a natural gas processing and ethane cracking plant, which yielded an estimate of ~1.6 billion USD. The equipment and installation cost of the 10 fired heaters comprises most of the capital expenditure, at ~85% of estimated capital cost. This makes sense as these units operate at 815℃ for extended periods of time, and even under careful operating conditions should be shut down and cleaned every 3-4 weeks to inhibit coking.

Operating Costs

Total operating costs were determined to be $2,122 (MM) by summing together the individual components of operating costs. Both variable operating costs and fixed operating costs were considered.

Fixed Operating Costs

Operating costs were split into fixed and variable operating costs. Fixed operating costs were largely calculated as an annual percentage of capital cost. Maintenance costs, property taxes and insurance, labor cost, management costs, and labor overhead were all included in fixed operating costs. All fixed operating costs were based on design principles in Towler and Sinnott.

| Cost Component | Cost ($MM) | Reasoning |

|---|---|---|

| Maintenance | $62.88 | 5% of Capital Cost |

| Property Taxes and Insurance | $25.15 | 2% of Capital Cost |

| Environmental Charges | $12.58 | 1% of Capital Costs |

| Labor Cost | $1.50 | 10 Employees per Shift |

| Management Cost | $0.60 | 40% of Labor Cost |

| Labor Overhead | $1.26 | 60% of Labor and Management costs |

| Total Fixed Costs | $103.97 |

Variable Operating Costs

The primary components of variable operating costs consisted of heating and cooling utilities, electricity costs from condensers and pumps, waste disposal costs, and raw material costs. After a heat exchanger network was developed and process heat recovery was optimized, total heating and cooling utility loads were extracted from ASPEN Energy Analyzer. Cost parameters for each type of utility were also estimated using data retrieved from ASPEN Energy Analyzer. Electricity costs were estimated using energy stream data from HYSYS and assuming a cost of electricity of $0.0662 per kW*hr - the average cost of industrial electricity in Ohio.

| Utilities | Cost ($MM) | Load (kJ/hr) | Cost ($/kJ) |

|---|---|---|---|

| Refrigerant 1 (C2H6) | $39 | 1.70E+09 | 0.000002739 |

| Refrigerant 4 (C2H4) | $194 | 2.70E+09 | 0.000008531 |

| Water | $2 | 1.40E+09 | 2.125E-07 |

| Fired Heat | $68 | 1.90E+09 | 0.000004249 |

| 100 PSI Steam | $55 | 3.40E+09 | 0.0000019 |

| Electricity | $189 | 1.22E+09 | 0.0662 ($/kWhr) |

| Total | $547 |

The final component of variable operating cost was the cost of raw materials and waste processing. Waste water treatment was assumed to cost $1.5 per metric ton (Towler). Our process inputs consist primarily of raw shale gas but also include water, MEA, and crude oil. The price of water was estimated from industrial water pricing in Ohio and the price of MEA was estimated using industrial suppliers from Alibaba. Raw shale gas costs can vary drastically depending on location, but were estimated using data from Morningstar’s energy observer. Wet gas costs in the Marcellus shale are among the cheapest in america and range from 1-3 dollars per thousand cubic feet of gas. Using the average value of $2 per thousand cubic feet, the cost per kilogram of raw shale gas was calculated.

| Raw Material | Cost ($MM) | Cost ($/KG) | Usage (Millions of KG/Year) |

|---|---|---|---|

| Shale Gas | $1,396 | 0.104 | 13440 |

| Oil | $66 | 0.368 | 184.8 |

| Water | $0.30 | 0.0007769 | $336.00 |

| MEA | $5 | 1.6 | 3.36 |

| Waste Disposal | $1 | 0.0015 | 644.7 |

| Total | $1,468.30 |

Estimating Revenues

Due to the extreme volatility in commodities pricing, revenues were not projected to be constant over the lifetime of the plant. Revenues were estimated using current commodities prices and futures from the Chicago Mercantile Exchange (CME). Future revenue estimations are shown in appendix V. An example of revenue calculations using current prices is shown below.

| Product | Revenue | Price($/kg) | Production (Millions of KG/Year) |

|---|---|---|---|

| Sales Gas | $1,557 | 0.1421 | 10953.6 |

| Polymer Grade Ethylene | $256 | 0.1568 | 1635.48 |

| Propane and Higher | $263 | 0.3232 | 812.95 |

| Total | $2,070 |

Based on these futures, revenue is expected to be approximately $2,900 MM on average between 2017-2026.

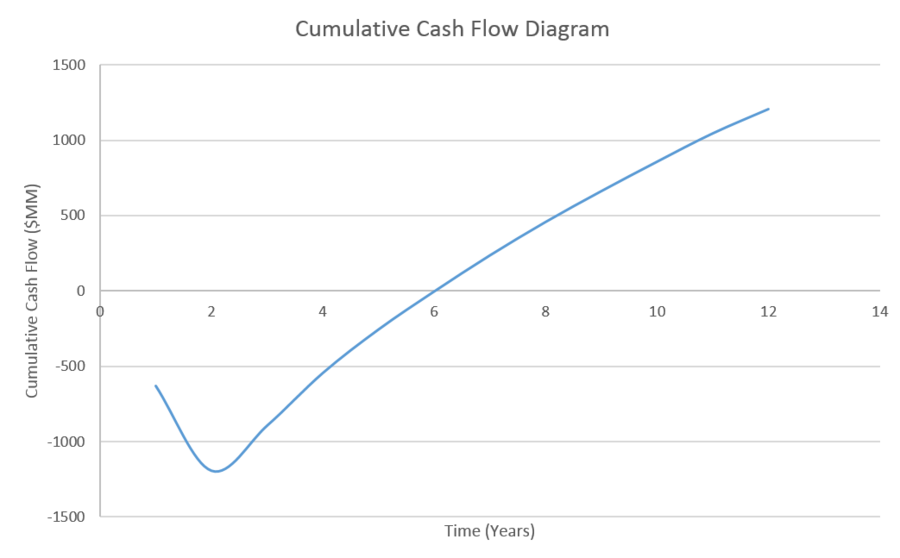

Profitability Analysis

Once all cost estimations were completed, a discounted cash flow analysis was performed to examine the economic viability of the process. The discount rate and corporate tax rate used for our analysis was determined by averaging the weighted average cost of capital (WACC) and corporate tax rates for a few large integrated oil and oil refining corporations. All data was retrieved via filings from the Securities and Exchange Commission. (Total S.A. was not included in the tax average due to an unusually high tax rate in 2014)

| Company | WACC | Tax Rate |

|---|---|---|

| Exxon Mobil | 11.08% | 41.18% |

| Chevron | 11.09% | 36.46% |

| BP | 9.67% | 29.99% |

| Total | 8.36% | 60.04% |

| Valero | 15.39% | 37.29% |

| Phillips 66 | 14.96% | 33.49% |

| Average | 11.76% | 35.68% |

Capital costs were depreciated over five years using MACRS depreciation and 1.5% annual inflation was added to operating costs. It was also assumed that the plant would take two years to build, all capital costs would come in the first two years, and production would start in the third year and last 10 years. It is extremely likely that a large scale chemical plant will be in operation for well over 10 years, but due to uncertainties in both commodities prices and future regulation against fossil fuels the model was only projected for 10 years of production.

| Net Present Value ($MM) | $1,206.60 |

|---|---|

| IRR | 28.99% |

| Discounted Payback Period | 6 Years |

Our initial cost estimations show that our process will be profitable in the long run as shown by a positive net present value and that the discounted payback period will be 6 years. It is very important to note that the cost estimations are extremely sensitive to commodities prices and future energy crises can greatly impact profitability.

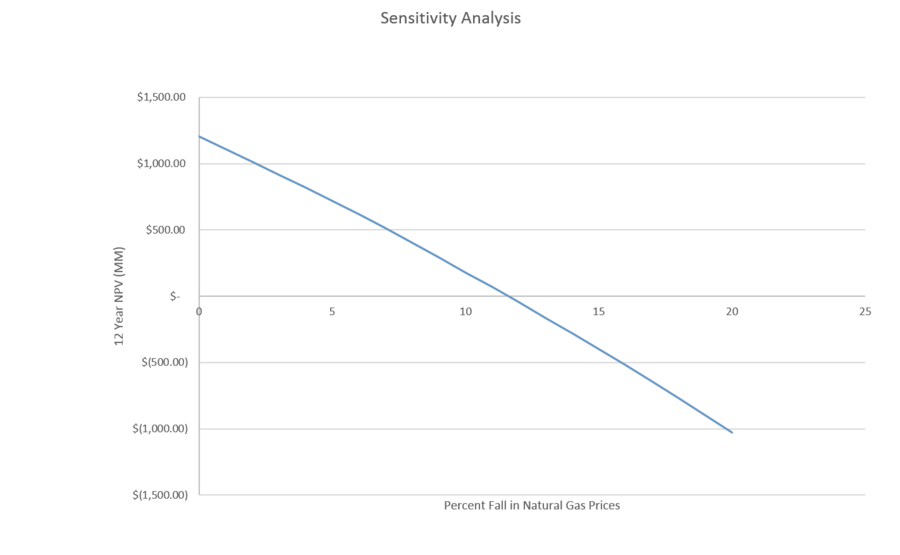

Sensitivity Analysis

If natural gas prices prices fall over 11%, the 12 year NPV will become negative. It is important to consider using financial instruments to hedge against commodity price declines and to ensure a positive net present value in a volatile future.

Conclusion and Future Steps

Using HYSYS, our integrated natural gas processing and ethylene production plants were simulated and we now have reasonable initial estimates of essential mass, energy, and equipment requirements. Additionally, using HYSYS economic analyzer and other correlations, we were able size and roughly determine the cost of building and operating the entire process. Although capital costs represent a significant investment relative to yearly revenue (~1.2-1.6 MMM$ versus ~2 MMM$), the most important factor in profitability is the price of obtaining raw shale gas. This price is volatile and sometimes difficult to determine. However, we are optimistic that the price of raw shale will decrease, and ethylene and crude oil prices will increase, to more normal levels. This analysis shows the significant economic potential of this plant over the long run.

Due to time constraints, there are some features of this topic that were left to be investigated further:

- More detailed reactor models

- Use kinetic parameters from literature to simulate cracking reaction

- Investigate imperfect heat and mass transfer effects in the coils of the fired heater

- Model hydrogenation reactor as a trickle bed reactor

- Find industrial data or use more detailed estimate for maintenance cost, especially for upkeep of fired heaters

- Optimize oil quench to minimize amount of makeup oil

- Simulate molecular sieve in HYSYS instead of using a fractionator (black box model)

- Implement process controls to ensure safety and product specifications

- Fired heater and cryogenic distillation columns operate at extreme temperatures and pressures - robust controls are necessary to safely operate these units industrially

References

Appendix I:Kinetic Data for Cracking Reactions

Appendix I:PFD

Appendix II:HYSYS Simulation

Appendix III:Stream Tables

Physical Flows

| Stream Name | Vapour Fraction | Temperature | Pressure | Molar Flow | Mass Flow | Std Ideal Liq Vol Flow | Heat Flow | Molar Enthalpy |

|---|---|---|---|---|---|---|---|---|

| Unit | C | kPa | kgmole/h | kg/h | m3/h | kJ/h | kJ/kgmole | |

| 1.00 | 0.00 | 13.63 | 3300.00 | 15444.33 | 464963.35 | 1304.09 | -1451630193.03 | -93991.15 |

| 10.00 | 0.77 | 85.00 | 200.00 | 33151.68 | 1504701.18 | 2493.40 | 146936992.00 | 4432.26 |

| 11.00 | 0.00 | 85.00 | 200.00 | 7704.30 | 979574.78 | 1014.21 | 834765908.14 | 108350.67 |

| 12.00 | 1.00 | 85.00 | 200.00 | 25447.38 | 525126.40 | 1479.19 | -687828916.14 | -27029.46 |

| 13.00 | 0.00 | 52.17 | 3200.00 | 0.00 | 0.00 | 0.00 | 0.00 | -62145.69 |

| 14.00 | 1.00 | 167.28 | 800.00 | 115335.33 | 2137181.35 | 6573.61 | -7001549894.80 | -60706.03 |

| 15.00 | 1.00 | 85.00 | 1150.00 | 115335.33 | 2137181.35 | 6573.61 | -7437971132.08 | -64489.96 |

| 16.00 | 1.00 | 85.00 | 1150.00 | 115329.64 | 2136475.68 | 6572.87 | -7438551228.64 | -64498.17 |

| 17.00 | 0.00 | 85.00 | 1150.00 | 5.68 | 705.67 | 0.74 | 580096.56 | 102048.40 |

| 18.00 | 1.00 | 193.18 | 3450.00 | 115329.64 | 2136475.68 | 6572.87 | -6888338395.16 | -59727.39 |

| 19.00 | 0.98 | 50.00 | 3400.00 | 115329.64 | 2136475.68 | 6572.87 | -7774939930.86 | -67414.93 |

| 20.00 | 1.00 | 50.00 | 3400.00 | 112647.72 | 2071082.61 | 6505.72 | -7076927053.62 | -62823.53 |

| 21.00 | 0.00 | 50.00 | 3400.00 | 2681.92 | 65393.07 | 67.15 | -698012877.25 | -260265.89 |

| 22.00 | 1.00 | 151.85 | 500.00 | 2220.36 | 40000.00 | 40.08 | -527984562.55 | -237792.37 |

| 23.00 | 0.00 | 50.00 | 3300.00 | 478.15 | 10635.15 | 10.73 | -128822521.79 | -269417.01 |

| 24.00 | 1.00 | 815.00 | 400.00 | 17583.65 | 502516.42 | 1337.33 | -589636222.29 | -33533.20 |

| 25.00 | 0.95 | 75.11 | 500.00 | 17583.65 | 502516.42 | 1337.33 | -1812856577.95 | -103098.97 |

| 26.00 | 1.00 | 65.52 | 3700.00 | 112094.82 | 2060447.45 | 6493.65 | -6910462284.47 | -61648.36 |

| 27.00 | 0.45 | -80.00 | 3700.00 | 112094.82 | 2060447.45 | 6493.65 | -8056436098.74 | -71871.62 |

| 28.00 | 1.00 | -102.85 | 3600.00 | 35877.80 | 476653.33 | 1725.29 | -2273837608.50 | -63377.28 |

| 30.00 | 0.00 | -72.23 | 3700.00 | 76217.02 | 1583794.11 | 4768.36 | -5851281194.57 | -76771.32 |

| 31.00 | 0.00 | -8.25 | 3400.00 | 7159.59 | 200932.46 | 525.29 | 272433957.92 | 38051.63 |

| 32.00 | 0.00 | 22.83 | 3500.00 | 17504.95 | 555532.88 | 1480.21 | -1610772980.75 | -92018.16 |

| 33.00 | 0.00 | 4.59 | 3300.00 | 210.96 | 6202.83 | 17.04 | -10597838.20 | -50236.51 |

| 35.00 | 0.00 | 13.77 | 3300.00 | 15233.37 | 458760.52 | 1287.04 | -1441032354.83 | -94597.08 |

| 37.00 | 0.00 | 815.00 | 400.00 | 0.00 | 0.00 | 0.00 | 0.00 | 19852.93 |

| 38.00 | 1.00 | 52.17 | 3200.00 | 112094.82 | 2060447.45 | 6493.65 | -6966208752.75 | -62145.68 |

| 39.00 | 0.00 | -91.54 | 3500.00 | 51552.48 | 827328.72 | 2762.87 | -4350211034.15 | -84384.13 |

| 4.00 | 0.00 | 85.03 | 300.00 | 7708.96 | 980185.64 | 1014.83 | 835377295.92 | 108364.43 |

| 44.00 | 1.00 | 25.00 | 500.00 | 15363.29 | 462516.42 | 1297.25 | -1284872015.40 | -83632.59 |

| 45.00 | 0.00 | 13.89 | 3600.00 | 24664.53 | 756465.36 | 2005.50 | -1338904877.84 | -54284.62 |

| 47.00 | 0.00 | -7.17 | 3450.00 | 17504.95 | 555532.88 | 1480.21 | -1675643568.80 | -95724.00 |

| 5.00 | 1.00 | 50.00 | 3300.00 | 112169.57 | 2060447.46 | 6495.00 | -6966208752.42 | -62104.27 |

| 56.00 | 0.00 | 85.03 | 300.00 | 7704.30 | 979574.78 | 1014.21 | 834895758.39 | 108367.53 |

| 57.00 | 1.00 | 83.00 | 2050.00 | 15444.33 | 464963.35 | 1304.09 | -1251581174.99 | -81038.24 |

| 6.00 | 1.00 | 815.00 | 400.00 | 25271.07 | 502515.53 | 1455.87 | 501704762.53 | 19852.93 |

| 7.00 | 1.00 | 40.31 | 200.00 | 115335.33 | 2137181.35 | 6573.61 | -7636729293.24 | -66213.27 |

| 8.00 | 0.00 | 95.00 | 300.00 | 171.64 | 22000.00 | 22.70 | 19239898.41 | 112092.53 |

| 9.00 | 1.00 | 358.60 | 300.00 | 33151.68 | 1504701.18 | 2493.40 | 1356321956.85 | 40912.62 |

| Acid Gas | 1.00 | 35.11 | 125.00 | 25.50 | 753.20 | 1.38 | -5671867.13 | -222457.38 |

| Ethane Recycle | 1.00 | 25.00 | 500.00 | 15444.33 | 464963.35 | 1304.09 | -1291563706.11 | -83627.05 |

| Ethylene Product | 0.00 | -11.15 | 3200.00 | 6948.63 | 194729.63 | 508.25 | 280794792.43 | 40410.10 |

| Make up Amine | 0.00 | 25.50 | 400.00 | 1907.26 | 40000.00 | 39.93 | -542957194.31 | -284679.91 |

| Natural Gas | 0.51 | -100.37 | 3500.00 | 87430.28 | 1303982.06 | 4488.15 | -6624048642.65 | -75763.78 |

| Propane and Propene | 0.00 | 75.55 | 3400.00 | 2271.58 | 96772.36 | 193.16 | -167499523.23 | -73737.11 |

| Sour Gas | 1.00 | 35.00 | 400.00 | 89187.71 | 1600211.06 | 5083.37 | -6748922057.14 | -75670.99 |

| Sweet Gas | 1.00 | 25.10 | 350.00 | 89887.95 | 1612054.95 | 5094.41 | -6948900377.10 | -77306.25 |

Composition Tables

All Compositions are in Mole Fractions

| Stream | Ethane | Hydrogen | Ethylene | CO2 | H2O | 13-Butadiene | Propene | Acetylene | Nitrogen | Propane | Methane | Naphthalene | i-Butane | MEAmine |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 0.987 | 0.000 | 0.009 | 0.000 | 0.000 | 0.000 | 0.002 | 0.000 | 0.000 | 0.002 | 0.000 | 0.000 | 0.000 | 0.000 |

| 4 | 0.004 | 0.000 | 0.003 | 0.000 | 0.001 | 0.000 | 0.001 | 0.000 | 0.000 | 0.000 | 0.000 | 0.990 | 0.000 | 0.000 |

| 5 | 0.137 | 0.068 | 0.062 | 0.000 | 0.000 | 0.000 | 0.006 | 0.001 | 0.005 | 0.013 | 0.707 | 0.000 | 0.000 | 0.000 |

| 6 | 0.269 | 0.302 | 0.277 | 0.000 | 0.088 | 0.000 | 0.028 | 0.003 | 0.000 | 0.001 | 0.032 | 0.000 | 0.000 | 0.000 |

| 7 | 0.134 | 0.066 | 0.061 | 0.000 | 0.026 | 0.000 | 0.006 | 0.001 | 0.005 | 0.013 | 0.688 | 0.002 | 0.000 | 0.000 |

| 8 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 1.000 | 0.000 | 0.000 |

| 9 | 0.206 | 0.230 | 0.212 | 0.000 | 0.067 | 0.000 | 0.021 | 0.002 | 0.000 | 0.001 | 0.025 | 0.235 | 0.000 | 0.000 |

| 10 | 0.206 | 0.230 | 0.212 | 0.000 | 0.067 | 0.000 | 0.021 | 0.002 | 0.000 | 0.001 | 0.025 | 0.235 | 0.000 | 0.000 |

| 11 | 0.004 | 0.000 | 0.003 | 0.000 | 0.001 | 0.000 | 0.001 | 0.000 | 0.000 | 0.000 | 0.000 | 0.990 | 0.000 | 0.000 |

| 12 | 0.268 | 0.299 | 0.275 | 0.000 | 0.087 | 0.000 | 0.027 | 0.003 | 0.000 | 0.001 | 0.032 | 0.007 | 0.000 | 0.000 |

| 13 | 0.137 | 0.067 | 0.063 | 0.000 | 0.000 | 0.000 | 0.006 | 0.000 | 0.005 | 0.013 | 0.708 | 0.000 | 0.000 | 0.000 |

| 14 | 0.134 | 0.066 | 0.061 | 0.000 | 0.026 | 0.000 | 0.006 | 0.001 | 0.005 | 0.013 | 0.688 | 0.002 | 0.000 | 0.000 |

| 15 | 0.134 | 0.066 | 0.061 | 0.000 | 0.026 | 0.000 | 0.006 | 0.001 | 0.005 | 0.013 | 0.688 | 0.002 | 0.000 | 0.000 |

| 16 | 0.134 | 0.066 | 0.061 | 0.000 | 0.026 | 0.000 | 0.006 | 0.001 | 0.005 | 0.013 | 0.688 | 0.001 | 0.000 | 0.000 |

| 17 | 0.012 | 0.000 | 0.004 | 0.000 | 0.002 | 0.000 | 0.001 | 0.000 | 0.000 | 0.003 | 0.014 | 0.960 | 0.000 | 0.003 |

| 18 | 0.134 | 0.066 | 0.061 | 0.000 | 0.026 | 0.000 | 0.006 | 0.001 | 0.005 | 0.013 | 0.688 | 0.001 | 0.000 | 0.000 |

| 19 | 0.134 | 0.066 | 0.061 | 0.000 | 0.026 | 0.000 | 0.006 | 0.001 | 0.005 | 0.013 | 0.688 | 0.001 | 0.000 | 0.000 |

| 20 | 0.137 | 0.068 | 0.062 | 0.000 | 0.004 | 0.000 | 0.006 | 0.001 | 0.005 | 0.013 | 0.704 | 0.000 | 0.000 | 0.000 |

| 21 | 0.003 | 0.000 | 0.001 | 0.000 | 0.934 | 0.000 | 0.000 | 0.000 | 0.000 | 0.001 | 0.003 | 0.057 | 0.000 | 0.000 |

| 22 | 0.000 | 0.000 | 0.000 | 0.000 | 1.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| 23 | 0.000 | 0.000 | 0.000 | 0.000 | 0.961 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.038 | 0.000 | 0.001 |

| 24 | 0.863 | 0.000 | 0.008 | 0.000 | 0.126 | 0.000 | 0.002 | 0.000 | 0.000 | 0.002 | 0.000 | 0.000 | 0.000 | 0.000 |

| 25 | 0.863 | 0.000 | 0.008 | 0.000 | 0.126 | 0.000 | 0.002 | 0.000 | 0.000 | 0.002 | 0.000 | 0.000 | 0.000 | 0.000 |

| 26 | 0.137 | 0.067 | 0.063 | 0.000 | 0.000 | 0.000 | 0.006 | 0.000 | 0.005 | 0.013 | 0.708 | 0.000 | 0.000 | 0.000 |

| 27 | 0.137 | 0.067 | 0.063 | 0.000 | 0.000 | 0.000 | 0.006 | 0.000 | 0.005 | 0.013 | 0.708 | 0.000 | 0.000 | 0.000 |

| 28 | 0.000 | 0.210 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.016 | 0.000 | 0.774 | 0.000 | 0.000 | 0.000 |

| 30 | 0.202 | 0.000 | 0.093 | 0.000 | 0.000 | 0.000 | 0.009 | 0.000 | 0.000 | 0.019 | 0.676 | 0.000 | 0.000 | 0.000 |

| 31 | 0.021 | 0.000 | 0.975 | 0.001 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.003 | 0.000 | 0.000 | 0.000 |

| 32 | 0.872 | 0.000 | 0.004 | 0.000 | 0.000 | 0.000 | 0.040 | 0.000 | 0.000 | 0.085 | 0.000 | 0.000 | 0.000 | 0.000 |

| 33 | 0.669 | 0.000 | 0.331 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| 35 | 0.992 | 0.000 | 0.004 | 0.000 | 0.000 | 0.000 | 0.002 | 0.000 | 0.000 | 0.002 | 0.000 | 0.000 | 0.000 | 0.000 |

| 37 | 0.269 | 0.302 | 0.277 | 0.000 | 0.088 | 0.000 | 0.028 | 0.003 | 0.000 | 0.001 | 0.032 | 0.000 | 0.000 | 0.000 |

| 38 | 0.137 | 0.067 | 0.063 | 0.000 | 0.000 | 0.000 | 0.006 | 0.000 | 0.005 | 0.013 | 0.708 | 0.000 | 0.000 | 0.000 |

| 39 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 1.000 | 0.000 | 0.000 | 0.000 |

| 44 | 0.987 | 0.000 | 0.009 | 0.000 | 0.000 | 0.000 | 0.002 | 0.000 | 0.000 | 0.002 | 0.000 | 0.000 | 0.000 | 0.000 |

| 45 | 0.625 | 0.000 | 0.286 | 0.000 | 0.000 | 0.000 | 0.028 | 0.000 | 0.000 | 0.060 | 0.001 | 0.000 | 0.000 | 0.000 |

| 47 | 0.872 | 0.000 | 0.004 | 0.000 | 0.000 | 0.000 | 0.040 | 0.000 | 0.000 | 0.085 | 0.000 | 0.000 | 0.000 | 0.000 |

| 56 | 0.004 | 0.000 | 0.003 | 0.000 | 0.001 | 0.000 | 0.001 | 0.000 | 0.000 | 0.000 | 0.000 | 0.990 | 0.000 | 0.000 |

| 57 | 0.987 | 0.000 | 0.009 | 0.000 | 0.000 | 0.000 | 0.002 | 0.000 | 0.000 | 0.002 | 0.000 | 0.000 | 0.000 | 0.000 |

| Acid Gas | 0.065 | 0.000 | 0.000 | 0.438 | 0.045 | 0.000 | 0.000 | 0.000 | 0.002 | 0.009 | 0.442 | 0.000 | 0.000 | 0.000 |

| Ethane Recycle | 0.987 | 0.000 | 0.009 | 0.000 | 0.000 | 0.000 | 0.002 | 0.000 | 0.000 | 0.002 | 0.000 | 0.000 | 0.000 | 0.000 |

| Ethylene Product | 0.002 | 0.000 | 0.994 | 0.001 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.004 | 0.000 | 0.000 | 0.000 |

| Make up Amine | 0.000 | 0.000 | 0.000 | 0.000 | 0.931 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.069 |

| Natural Gas | 0.000 | 0.086 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.007 | 0.000 | 0.907 | 0.000 | 0.000 | 0.000 |

| Propane and Propene | 0.067 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.290 | 0.000 | 0.000 | 0.639 | 0.000 | 0.000 | 0.000 | 0.000 |

| Sour Gas | 0.096 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.006 | 0.016 | 0.880 | 0.000 | 0.000 | 0.000 |

| Sweet Gas | 0.096 | 0.000 | 0.000 | 0.000 | 0.008 | 0.000 | 0.000 | 0.000 | 0.006 | 0.016 | 0.873 | 0.000 | 0.000 | 0.000 |

Energy Tables

| Name | Heat Flow (kJ/h) |

|---|---|

| Q-102 | 1.22E+09 |

| Q-103 | -1.81E+07 |

| Q-104 | 5.72E+08 |

| Q-105 | 5.03E+08 |

| Q-106 | 5.57E+07 |

| Q-107 | 1.15E+09 |

| Q-108 | 1.42E+09 |

| Q-109 | 1.42E+09 |

| Q-110 | 6.49E+07 |

| Q-111 | 6.35E+08 |

| Q-112 | 5.77E+08 |

| Q-113 | 1.09E+09 |

| Q-114 | 1.21E+09 |

| Q-115 | 9.57E+08 |

| Q-116 | 5.10E+08 |

| Q-117 | 7.95E+08 |

| Q-118 | 2.58E+08 |

| Q-119 | 5.50E+08 |

| Q-120 | 2.56E+08 |

| Q-124 | 1.30E+05 |

| Q-125 | 2.00E+08 |

| Q-126 | 4.00E+07 |

| Q-127 | -8.87E+08 |

| Q-128 | -4.36E+08 |

Appendix V: Capital Costs and Equipment Sizing

Appendix IV:Utilities

Heat Exchanger Utilities

| Utility Type | Cost ($MM) | KJ/Hr | Cost/KJ |

|---|---|---|---|

| Water | $2.46 | 1.378E+09 | 0.0000002125 |

| Refrigerant 1 | $1.50 | 65010000 | 0.000002739 |

| Refrigerant 4 | $95.59 | 1.33E+09 | 0.000008531 |

| Fired Heat | $68.07 | 1.91E+09 | 0.000004249 |

| 100 PSI Steam | $0.52 | 32820000 | 0.0000019 |

| Total | $168.14 |

Distillation Condensers and Reboilers Utility Usage

| Utility Type | Cost ($MM) | KJ/Hr | Cost/KJ |

|---|---|---|---|

| Refrigerant 1 | $37.91 | 1.65E+09 | 2.74E-06 |

| Refrigerant 4 | $98.15 | 1.37E+09 | 8.53E-06 |

| Water | $0.01 | 4.76E+06 | 2.13E-07 |

| 100 PSI Steam | $54.10 | 3.39E+09 | 0.0000019 |

| Total | $190.17 |

Electricity Costs

| Cost ($MM) | Energy Load (kJ/hr) | Unit Cost of Electricity ($/kWhr) | |

|---|---|---|---|

| Electricity Costs | $188.53 | 1.22E+09 | 0.0662 |

Appendix V:Future Revenue Projections

| Year | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sales Gas cost ($/kg) | 2.71 | 3.27 | 3.62 | 3.80 | 3.90 | 3.99 | 4.10 | 4.24 | 4.37 | 4.49 | 4.63 | 4.63 |

| Polymer Grade Ethylene Cost ($/kg) | 0.34 | 0.34 | 0.36 | 0.38 | 0.39 | 0.40 | 0.41 | 0.42 | 0.44 | 0.45 | 0.46 | 0.46 |

| Propane and Higher Cost ($/kg) | 0.61 | 0.66 | 0.66 | 0.67 | 0.68 | 0.70 | 0.72 | 0.74 | 0.77 | 0.79 | 0.81 | 0.81 |

| Total Revenue (MM) | $2069 | $2409 | $2628 | $2753 | $2818 | $2889 | $2965 | $3065 | $3163 | $3251 | $3350 | $3350 |

Appendix VI: Discounted Cash Flow Statement

| Year: | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | $ 2,628.00 | $ 2,753.00 | $ 2,818.00 | $ 2,889.00 | $ 2,965.00 | $ 3,065.00 | $ 3,163.00 | $ 3,251.00 | $ 3,350.00 | $ 3,350.00 | ||

| Capital Expenditures | $(629.00) | $ (629.00) | $ - | $ - | $ - | $ - | $ - | $ - | $ - | $ - | $ - | $ - |

| Operating Costs | $ - | $ - | $(2,186.00) | $(2,219.00) | $(2,252.00) | $(2,286.00) | $(2,320.00) | $(2,355.00) | $(2,390.00) | $(2,426.00) | $(2,463.00) | $(2,500.00) |

| Depreciation | $ - | $ - | $ (252.00) | $ (402.00) | $ (241.00) | $ (145.00) | $ (145.00) | $ (72.00) | $ - | $ - | $ - | $ - |

| Taxes | $ - | $ - | $ (68.00) | $ (47.00) | $ (116.00) | $ (163.00) | $ (178.00) | $ (228.00) | $ (276.00) | $ (294.00) | $ (317.00) | $ (304.00) |

| Free Cash Flow | $(629.00) | $ (629.00) | $ 374.00 | $ 487.00 | $ 450.00 | $ 439.00 | $ 467.00 | $ 483.00 | $ 497.00 | $ 531.00 | $ 571.00 | $ 547.00 |

| Present Value FCF | $(629.00) | $ (563.00) | $ 299.00 | $ 349.00 | $ 289.00 | $ 252.00 | $ 239.00 | $ 222.00 | $ 204.00 | $ 195.00 | $ 188.00 | $ 161.00 |

| Cumulative FCF | $(629.00) | $(1,191.00) | $ (892.00) | $ (543.00) | $ (254.00) | $ (2.00) | $ 237.00 | $ 459.00 | $ 663.00 | $ 858.00 | $ 1,046.00 | $ 1,207.00 |

Appendix VII: Sensitivity Analysis Results

| Fall in Commodities Prices | NPV (MM) |

|---|---|

| 0% | $ 1,207 |

| 1% | $ 1,110 |

| 2% | $ 1,013 |

| 3% | $ 916 |

| 4% | $ 819 |

| 5% | $ 721 |

| 6% | $ 617 |

| 7% | $ 513 |

| 8% | $ 404 |

| 9% | $ 292 |

| 10% | $ 181 |

| 11% | $ 70 |

| 12% | $ (45) |

| 13% | $ (163) |

| 14% | $ (280) |

| 15% | $ (398) |

| 16% | $ (517) |

| 17% | $ (641) |

| 18% | $ (770) |

| 19% | $ (900) |

| 20% | $ (1,029) |